Outrage in South Africa: October 2025 VAT Trap Looms Over R284.7 Billion Grant Budget: The recent announcement regarding South Africa’s fiscal policy has raised significant concern across the nation. With an impending value-added tax (VAT) trap looming over a substantial R284.7 billion grant budget scheduled for October 2025, citizens and economic experts alike are voicing their anxieties. This potential VAT increase threatens to exacerbate financial strains on various social grants and public programs critical to the livelihoods of millions. As South Africa navigates the complexities of economic recovery amid global challenges, the implications of this VAT decision could be far-reaching, impacting everything from consumer prices to public service funding. The government faces mounting pressure to mitigate these effects and find a sustainable path forward.

Understanding the R284.7 Billion Grant Budget

The R284.7 billion grant budget is a cornerstone of South Africa’s social welfare strategy, aimed at supporting vulnerable populations through various social grants. These grants cover a wide range of needs, including child support, disability assistance, and old-age pensions. The allocation of this budget is crucial for maintaining social stability and reducing poverty levels across the country. However, the looming VAT implications threaten to undermine these efforts. As VAT is a consumption tax levied on goods and services, an increase would likely lead to higher prices, putting additional strain on households that rely on these grants. The government is tasked with ensuring that the allocation of this budget effectively reaches those in need while navigating the potential economic fallout of a VAT hike.

- Child Support Grant

- Old Age Pension

- Disability Grant

- Foster Child Grant

- Care Dependency Grant

- War Veterans Grant

- Grant-in-Aid

- Social Relief of Distress

Potential Impact of the VAT Increase on Households

The potential VAT increase poses a significant threat to South African households, particularly those already struggling to make ends meet. For families depending on social grants, any rise in the cost of living could lead to increased financial hardship. The VAT on essential goods, such as food and basic utilities, would directly affect household budgets, limiting the ability to afford necessities. This could lead to a cycle of poverty where families are forced to make difficult choices between essential needs. Moreover, the economic ripple effect could extend beyond individual households, affecting local businesses that rely on consumer spending. The overarching concern is that the VAT increase might stall economic growth and further widen the gap between the wealthy and the impoverished.

| Grant Type | Beneficiaries | Current Amount | Potential Impact | Projected Increase | Outcome |

|---|---|---|---|---|---|

| Child Support | 12 million | R480 | Higher Childcare Costs | R50 | Increased Poverty |

| Old Age Pension | 3.5 million | R2,080 | Rising Medical Expenses | R100 | Reduced Savings |

| Disability | 1 million | R1,980 | Accessibility Issues | R90 | Healthcare Challenges |

| Foster Child | 500,000 | R1,040 | Increased Living Costs | R60 | Strain on Foster Families |

| Care Dependency | 200,000 | R1,980 | Medical Equipment Costs | R100 | Financial Burden |

| War Veterans | 100,000 | R2,080 | Rising Costs of Living | R80 | Decreased Quality of Life |

| Grant-in-Aid | 150,000 | R480 | Assistive Care Expenses | R40 | Limited Support |

| Social Relief | Variable | R350 | Emergency Needs | R30 | Insufficient Aid |

Government’s Role in Mitigating the VAT Trap

The South African government has a pivotal role in addressing the potential VAT trap and its impact on the R284.7 billion grant budget. To mitigate adverse effects, several strategies could be employed. Firstly, the government could consider expanding the zero-rated list of basic goods, ensuring that essential items remain affordable for low-income households. Secondly, increasing the grant amounts to offset the potential rise in living costs could provide immediate relief to affected families. Additionally, implementing targeted subsidies for essential services such as electricity and water could help cushion the blow. Transparency and public engagement are also critical, as they foster trust and collaboration between the government and citizens. Engaging with stakeholders, including non-profit organizations and community leaders, can provide valuable insights and foster innovative solutions to tackle this challenge.

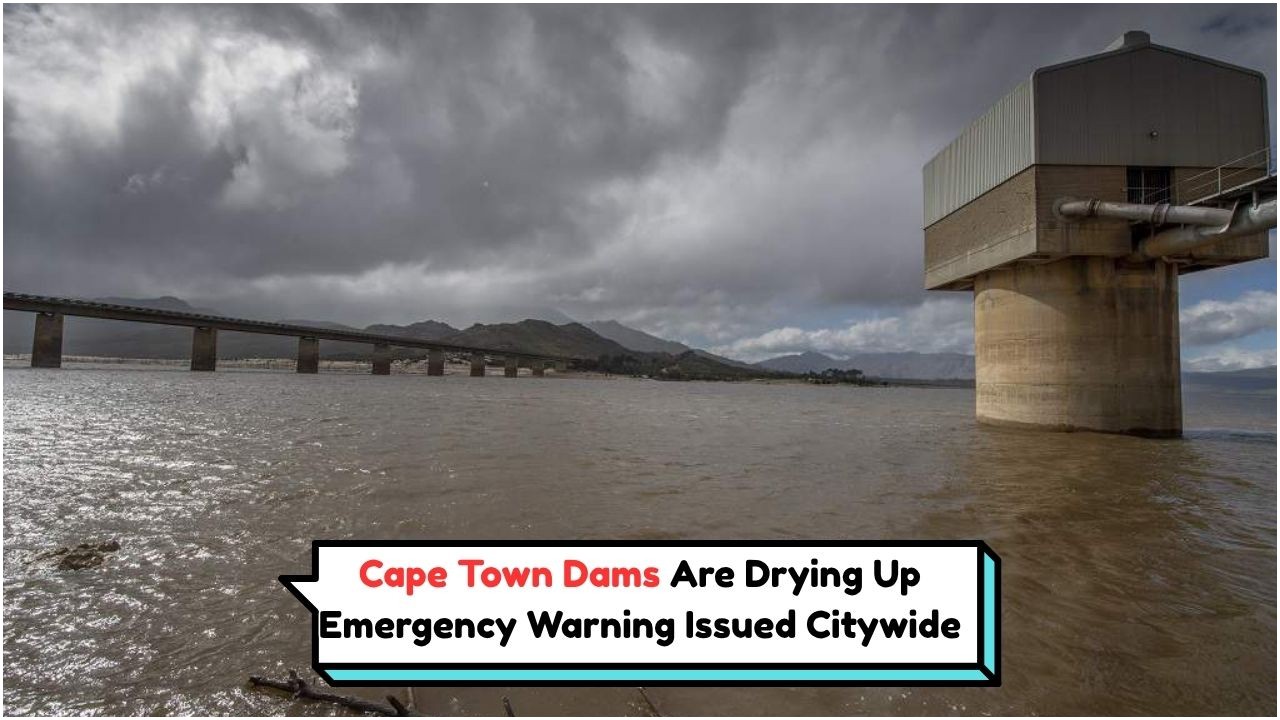

Thousands Stranded by August NSFAS Blockages: Discover the Viral R5,200 WhatsApp Hack to Solve It

Thousands Stranded by August NSFAS Blockages: Discover the Viral R5,200 WhatsApp Hack to Solve It

- Expand Zero-Rated Goods

- Increase Grant Amounts

- Provide Subsidies for Essentials

- Enhance Transparency

- Engage with Communities

- Monitor Economic Impact

Public Response to the VAT Increase

The announcement of a potential VAT increase has sparked widespread public outcry, with many South Africans expressing concern over the impact on their daily lives. Citizens have taken to social media platforms to voice their dissatisfaction, calling on the government to reconsider the decision. Community organizations and advocacy groups have also rallied, organizing protests and petitions to demand action. The public sentiment reflects a deep-seated fear of economic instability and a loss of purchasing power. This response underscores the importance of transparent communication from the government, as well as the need for meaningful engagement with citizens to address their concerns. By actively involving the public in the decision-making process, the government can build trust and work towards solutions that prioritize the welfare of all South Africans.

| Public Concern | Response | Action Taken | Outcome |

|---|---|---|---|

| Rising Costs | Petitions | Submitted to Parliament | Awaiting Response |

| Economic Instability | Protests | Organized Nationwide | Increased Awareness |

| Loss of Purchasing Power | Online Campaigns | Viral on Social Media | Government Statements |

| Lack of Transparency | Community Meetings | Engagement with Officials | Ongoing Dialogues |

| Social Inequality | Advocacy Initiatives | Collaborations with NGOs | Policy Proposals |

Long-Term Solutions for VAT and Grant Budget

To address the challenges posed by the VAT increase and ensure the sustainability of the R284.7 billion grant budget, long-term solutions are necessary. One approach is to diversify South Africa’s revenue streams by investing in sectors such as renewable energy and technology, which offer growth potential and job creation. Additionally, reforming tax policies to ensure that wealthier individuals and corporations contribute their fair share can alleviate the financial burden on lower-income groups. Strengthening anti-corruption measures is also crucial to ensure that public funds are used effectively and transparently. By implementing these strategies, South Africa can build a more resilient economy that supports its most vulnerable citizens while fostering inclusive growth.

- Diversify Revenue Streams

- Invest in Renewable Energy

- Reform Tax Policies

- Strengthen Anti-Corruption Measures

Key Takeaways from the VAT Trap

The looming VAT trap over South Africa’s R284.7 billion grant budget serves as a critical reminder of the interconnectedness of fiscal policy and social welfare. Key takeaways from this situation include the need for proactive government intervention to protect vulnerable populations and the importance of public engagement in decision-making processes. The potential VAT increase highlights the challenges of balancing economic growth with social equity, emphasizing the need for innovative solutions and collaborative approaches. By addressing these issues head-on, South Africa can pave the way for a more inclusive and sustainable future.

| Takeaway | Description | Implication | Action |

|---|---|---|---|

| Government Intervention | Protect Vulnerable Populations | Ensure Social Welfare | Expand Support Programs |

| Public Engagement | Involve Citizens in Decision-Making | Build Trust | Foster Dialogue |

| Economic Balance | Growth vs. Equity | Ensure Fair Distribution | Innovative Policies |

| Collaborative Approaches | Work with Stakeholders | Enhance Solutions | Partnerships |

| Sustainable Future | Long-Term Planning | Resilient Economy | Diversified Growth |

Frequently Asked Questions

What is the R284.7 billion grant budget?

The R284.7 billion grant budget is a financial allocation by the South African government aimed at supporting social welfare programs across the country.

How could the VAT increase affect social grants?

An increase in VAT could lead to higher prices for goods and services, reducing the purchasing power of social grants and impacting vulnerable families.

What measures can the government take to mitigate the VAT impact?

The government could expand zero-rated goods, increase grant amounts, and provide subsidies for essential services to alleviate the impact.

Why is public engagement important in this context?

Public engagement fosters trust and ensures that government decisions reflect the needs and concerns of citizens, leading to more effective policies.

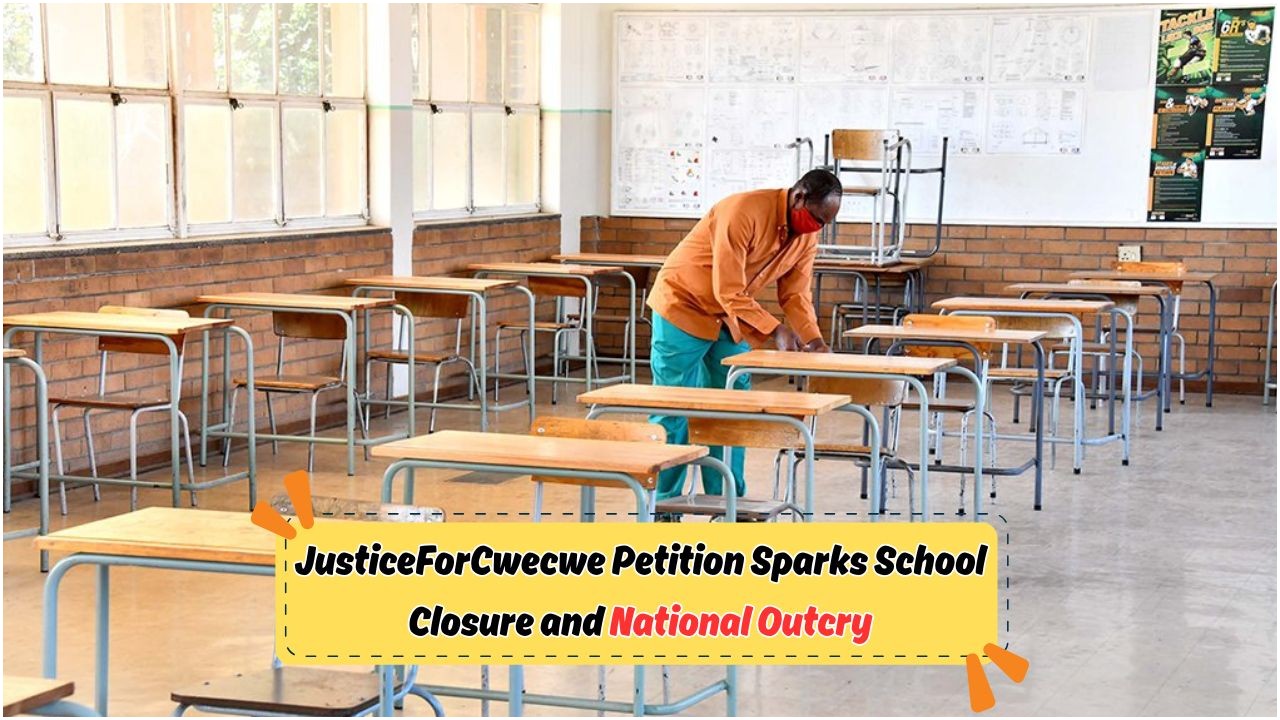

Eastern Cape School Shuts Down Amid #JusticeForCwecwe Uproar: Parents Call for Immediate Action

Eastern Cape School Shuts Down Amid #JusticeForCwecwe Uproar: Parents Call for Immediate Action

What are the long-term solutions to address the VAT trap?

Long-term solutions include diversifying revenue streams, reforming tax policies, and strengthening anti-corruption measures to build a resilient economy.